|

|

#1 |

|

x'); DROP TABLE FFR;--

Join Date: Nov 2010

Posts: 6,332

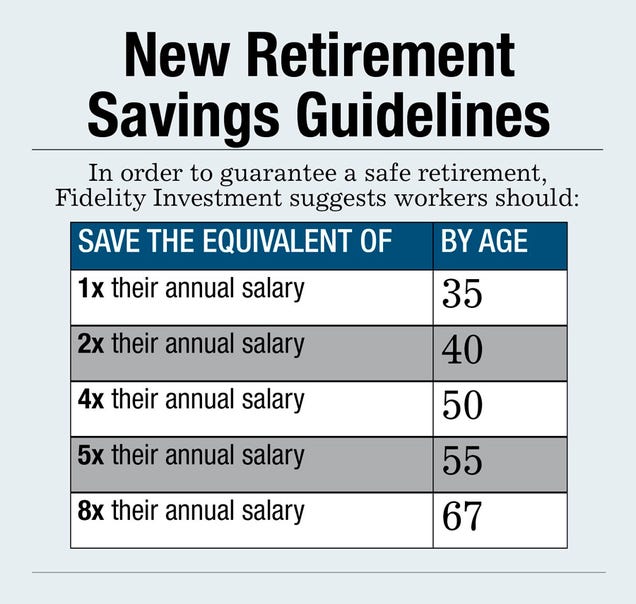

|

Here is a personal finance walkthrough (for people who live in America), in the following order:

1. Build up an emergency fund that will cover all your expenses (rent, food, bills, loans, everything) for 3-6 months. This is a "slush fund" that will keep you afloat in the event that something unexpected happens, such as losing your job or getting hit with a medical expense. Store it in something reasonably liquid, like an interest savings/checking account or a money market account. If you ever find that you need to draw money from this fund, immediately begin working to replenish it. 2. Max 401k company match. Hopefully your employer offers this. If your employer offers to match contributions up to x%, then you should contribute x%. In other words, contribute the amount that will maximize how much your employer will match. This is a tax-advantaged 100% guaranteed return on your money, so you need to hop on this before you even consider anything else. 3. Pay off high-interest debts. Especially credit card debt -- that shit has got to go. I personally define high as 4% or greater. There are two approaches to this. The "avalanche method" means you order your debts by interest rate and just start chipping away at the highest-rated debt and work your way down. This is the mathematically optimal approach that minimizes your overall cost (i.e. the amount you're wasting to interest), but some people do well with the "snowball method," where you arrange debts by the sizes of the balances instead. While not necessarily mathematically optimal, it is psychologically satisfying to eliminate debt, and the quickest way to do this is to go after the smallest balances. By eliminating debts sooner, it can inspire you to get more aggressive about paying the rest off, and it will help keep you motivated. Decide which method works best for you (I've used a bit of both, but mostly avalanche). Low-interest debt you can ignore for now. 4. Maximize your IRA. These are also tax-advantaged accounts. Why not contribute more to the 401k at this point, you might ask? With your employer, what they offer is what you get. With IRAs, you can open these up externally and pick/choose from all sorts of quality, low-cost providers such as Vanguard or Fidelity. There is a max contribution limit, so once you max this out... 5. Maximize the rest of your 401k. No point in giving up that tax advantage. 6. At this point, you have some freedom. Add more to the emergency fund? Sure. Pay off low-interest debt? Sure. Save up for a house? Sure. Whatever will make you happy, go for it -- at this point you've already eliminated your high-interest debt and are saving over $20k/year for retirement. 7. Taxable investment / brokerage accounts, for when you want to save even more. How much should you have saved for retirement? This is Fidelity's recommendation:  I don't agree with it 100%, but it's a great start for most people (personally, I'd say a year's salary by age 30). Am I saying that you can't spend money and have fun in the meantime? Nope, you should treat yourself from time to time -- but you have to be smart about it. The more money you spend now, the more money you are taking away from your future self. You have to determine what an appropriate tradeoff will be. For example maybe you'd rather start saving for something like a house after step 4. Nothing wrong with that as long as you know what you're giving up in the long run. Last edited by Reincarnate; 02-25-2015 at 09:41 PM.. |

|

|

|

|

|

#2 |

|

The Dominator

Join Date: Sep 2005

Location: North Bay, ON

Age: 34

Posts: 8,987

|

Save ya money fools

|

|

|

|

|

|

#3 |

|

x'); DROP TABLE FFR;--

Join Date: Nov 2010

Posts: 6,332

|

Investment walkthrough (401k, IRA, taxable accounts, etc):

Most people, when they think of investing, think they have to predict which stocks are going to take off, which points in time are the best to buy low, and which points in the time are the best to sell high. I'm here to tell you to ignore that shit, because nobody can do it reliably and consistently, especially over the long run. This is a concept called "market timing," which is a fancy-pants term for "trying to predict what the market will do in the future." There are various reasons why this is a bad idea, but I won't get into it in detail here. For the vast, vast, vast majority of people, trying to time the market (as a general strategy) will make you underperform the method I'm about to describe (over the long term). Yes, you could predict something correctly and become wildly rich, or you could be wrong and become poor as fuc. There's no need to take on this kind of risk to become financially stable over the long term. So what should you do? 1. Don't time the market. 2. Diversify your portfolio. 3. Buy low-cost index funds (that approximate the entire market) and use a reasonable asset allocation. More on this later. 4. Buy these funds as often as you can stand it. 5. Ignore what the market is doing. Keep following step 4, no matter what. That's it! Not very interesting, is it? The funny thing is that over the long run, you will beat most strategies. You won't beat them all, but the people who do better (in terms of market investment) are generally the ones who took big risks -- risks that could have easily gone against their favor all the same. Last edited by Reincarnate; 02-25-2015 at 09:21 PM.. |

|

|

|

|

|

#4 |

|

x'); DROP TABLE FFR;--

Join Date: Nov 2010

Posts: 6,332

|

Asset allocation:

Okay, so how should you arrange your 401k / IRA / your portfolio in general? This is where things become highly personalized, as they depend a lot on your tolerance for risk, your age, your goals, etc. Your portfolio should probably be a mix of diversified stocks and bonds. Stocks are riskier investments that can move around a lot, whereas bonds are more stable / less risky, but don't offer as great a return as stocks do. The general idea is that when you're young, you can afford to invest more of your portfolio in equities / stocks because you have a lot of time to absorb negative downswings / build wealth, whereas if you're older, you may want more bonds in your portfolio to stabilize things and prevent you from losing too much in a downswing as you're nearing retirement age. You'll find all sorts of heuristics out there, but a simple one is this: 1/3 allocated to the total US stock market 1/3 allocated to the international stock market 1/3 allocated to the total bond market If you're using Vanguard, for example, this might mean using the index funds VTSMX, VGTSX, and VBMFX. And then every year or so, you "rebalance" your portfolio by adjusting your allocation percentages so that everything goes back into 1/3 1/3 1/3 ratio (some pieces will outperform others, so rebalancing means you are in effect buying low and selling high without market timing, and calibrating everything back to your desired risk profile). If you invest in something like a Target Retirement account, this is all handled for you. It's also important that your funds be low-cost. This is built into something called the "expense ratio" (which is listed explicitly). If you need a guide: <=0.10%: Fantastic 0.11% - 0.25%: Perfectly fine 0.26% - 0.30%: Probably OK, but maybe look for alternatives, if possible. 0.31% - 0.50%: Ehhhhhhhhhhhhhhh... Over 0.50%: Forget it, unless it's something really good. Most likely too expensive, though. If your funds aren't low-cost, they will really eat at your gains over the long run. Last edited by Reincarnate; 02-25-2015 at 10:24 PM.. |

|

|

|

|

|

#5 |

|

x'); DROP TABLE FFR;--

Join Date: Nov 2010

Posts: 6,332

|

(I have simplified all of this quite a bit, and there are various bits to improve / optimize here and there, but you should probably understand the basics that I've outlined above before tweaking things)

The strategies as listed in this thread so far will do quite well for most people. The goal of this thread was to keep it short and sweet, and give people a braindead template to follow. Oh, one more thing: If you do plan to get a financial advisor of any kind, make sure they advise in a "fiduciary capacity" / ask if they are fee-only. If not, it means they will probably try to sell you shit even if it's not in your best interest. You want advisors that will help you maximize your financial strength. Last edited by Reincarnate; 02-25-2015 at 10:26 PM.. |

|

|

|

|

|

#6 |

|

slimy, yet ... satisfying

Join Date: May 2007

Age: 31

Posts: 1,244

|

This is a reasonable lay of the land, and I think you did well not to go too far into the fine details. Granted, my knowledge is severely lacking in some of these topics, but then again I'm not really in a position where these are my main concern (still a student with little to no income).

Regardless, I'll be revisiting this thread in the future for sure. Thanks man! |

|

|

|

|

|

#7 | |

|

x'); DROP TABLE FFR;--

Join Date: Nov 2010

Posts: 6,332

|

If you happen to be on the young side (late teens, 20's, etc) it's an especially good time to get in the habit of saving. Every little bit helps. Why?

Quote:

A lot of people don't even start thinking about this stuff until they're well into their 30's and 40's, sometimes even later. If you can start the process now, you will be WAY ahead of the rest. Last edited by Reincarnate; 02-25-2015 at 08:23 PM.. |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|